Since the an initial time homebuyer this will probably getting certainly one of the greatest monetary choices it is possible to ever before create. Below are a few questions you ought to question. How much loans perform We have?

To find out more, a good connections might be a monetary advisor, a great mortgage broker, or their bank movie director

Before you could undertake an enormous economic obligation one to a good house is – you need to pay off, otherwise you’re your existing obligations load. Maybe first off, you will want to guarantee that because you clean out financial obligation, you improve credit history. In which will i feel living in dos so you can five years?

If you’re planning to your being in a certain spot for a few days (two years otherwise quicker), up coming leasing can be a reasonable monetary choice. Buying and you may/or selling property comes with relevant will set you back. Your house will most likely not build enough equity in 2 years to help you justify purchasing a home and legal charges double. Do you know the field standards near you?

Due to fancy, you are going to you may read a rough increase in value of away from 4-six % a year, meaning over the 2nd 5 years you will have property that’s worth on the 29% over when you own it. This should promote extra dollars to repay college loans and you may other costs, and strengthening an effective credit rating at the same go out. Thinking trailing to invest in real estate is to get a mind start increase debt future. Should you decide with the being in a place for a couple of years or even more, then you certainly should consider to buy. Not only can your property escalation in well worth, however you will become spending less monthly. Getting mixed up in real estate market becomes smaller terrifying when your keep yourself well-informed. You will find benefits to becoming a citizen, instance a constant lifestyle and viewing your investment enjoy into the worth. A home have always had so much more security versus stock-exchange, regrettably there’s no sure treatment for influence ideal time and energy to buy, you to definitely decision should be considering personal activities and you can earnings. you don’t need to do this alone, a beneficial broker or financial manager and you will an educated real estate agent can assist.

You will find a question easily registered the application form due to the fact one first-time homebuyer, and then are engaged, should i incorporate someone to this option with me? Otherwise get approved to get more according installment loans in Colorado to here are even more money towards the housing can cost you?

Paying off balances can be change your fico scores a great deal

Probably really should not be problems though one thing you may need to love has too-much income in the event the an application features restriction income constraints. However, keep in mind each other borrowers cannot will have to-be towards mortgage if it’s not advantageous.

Question my husband and you can l need buy a house given that earliest go out customers we where convinced FHA. l have numerous credit cards l have always been taking my balance lows and you will going to spend financing l provides out-of therefore we may our very own get ups. Whenever we earliest seated down which have a mortgage providers, it told you i was not away from in which i would have to be within the rating smart that way do you really believe this will help my husband and i. You want to get in all of our brand new home within a-year from today.

..it’s difficult to express exactly how much without knowing all the information however it is basically very useful. Additionally, it may allow you to use much more once you’ve shorter an excellent loans.

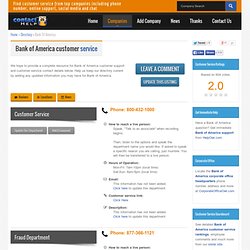

Leave A Comment