- Upload elizabeth-send in order to Gigi O’Brien

- Open LinkedIn character out of Gigi O’Brien

- ” data-up-hook-social-utility-bar=”[socialLinks]” href=”#” data-url-pattern=”” target=”_blank” aria-label=”Facebook” title=”Facebook” rel=”noopener noreferrer”> Myspace

- ” data-up-hook-social-utility-bar=”[socialLinks]” href=”#” data-url-pattern=”” target=”_blank” aria-label=”Twitter” title=”Twitter” rel=”noopener noreferrer”> Twitter

- ” data-up-hook-social-utility-bar=”[socialLinks]” href=”#” data-url-pattern=”” target=”_blank” aria-label=”LinkedIn” title=”LinkedIn” rel=”noopener noreferrer”> LinkedIn

- “> Hook up Copied

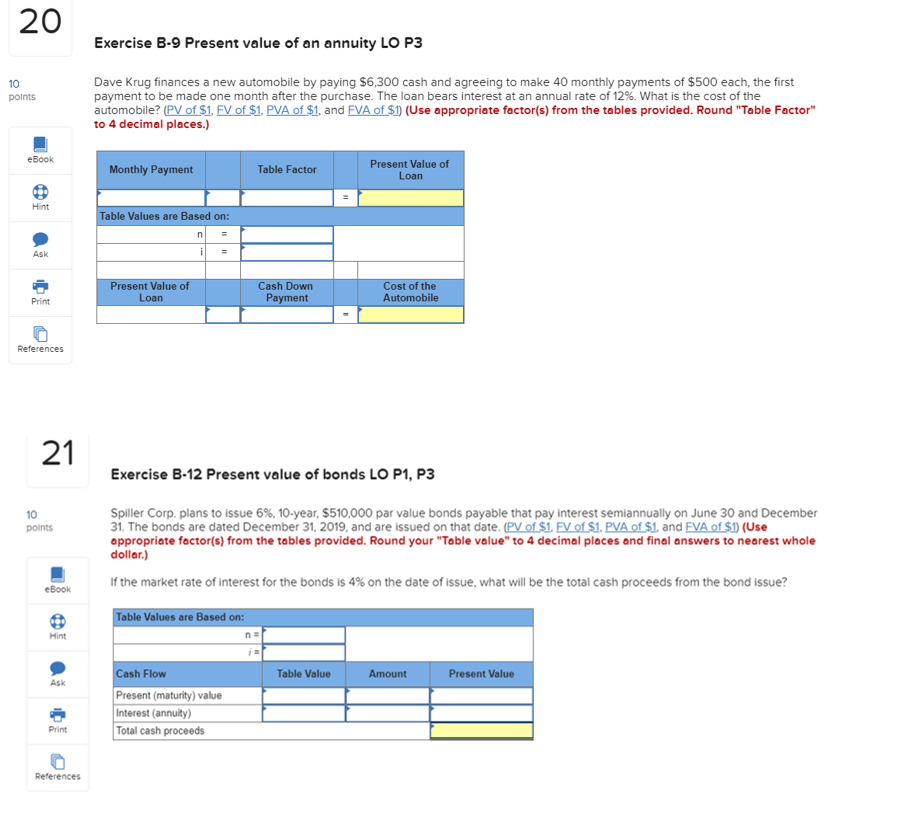

Due to the fact eurozone benefit is forecast to enhance only 0.5% over 2023, and 0.6% during the 2024, full lender lending is expected to help you declaration more compact growth of 2.1% in 2023, while this is a fall off a great 14-seasons most of 5% year-on-year development in 2022. Credit volumes often slower start to pick-up, with growth interacting with dos.3% during the 2024, 3.2% from inside the 2025 and you can 3.3% within the 2026, offered the new European Central Financial price cuts expected inside the 2024 materialise. Total, this should slow down the price of domestic and you will business funds and you will boost demand for borrowing.

Eurozone bank lending to help you houesholds and firms

- Eurozone home loan credit forecast to enhance simply 1.5% in 2023 and you can 2.4% from inside the 2024 the lowest increases more a two-year several months from inside the ten years in just some higher growth of 3.3% (net) prediction when you look at the 2025

- Interest in consumer credit in order to sluggish to 1.6% over 2023 and only develop step one.9% when you look at the 2024, off off dos.7% for the 2022

- Bank-to-business financing anticipate to grow dos.7% this season ahead of reducing so you’re able to 2.2% from inside the 2024 which have asked contractions about Italian and you can Foreign-language places

- Eurozone non-undertaking finance to rise only somewhat this year, which have The country of spain and you will Italy anticipate to statement the highest rates due on the high volume of varying-speed mortgages

Mortgage lending over the eurozone is expected in order to record , according to the latest EY Western european Bank Financing Economic Forecast, as the high credit can cost you, poor economic growth and you may shedding housing market sentiment decrease consult. Within the online conditions, mortgage loans are expected to rise simply 1.5% for the 2023 and 2.4% in 2024, representing the newest slowest development in a decade.

While the eurozone cost savings are prediction to enhance simply 0.5% more than 2023, and you can 0.6% into the 2024, complete bank credit is anticipated so you can statement smaller growth of 2.1% into the 2023, although this is an autumn away from a great 14-year a lot of 5% year-on-season growth in 2022. Credit amounts usually reduced begin to pick-up, having progress reaching dos.3% when you look at the 2024, step three.2% inside 2025 and you will step 3.3% in the 2026, considering brand new Eu Central Financial rates cuts asked during the 2024 materialise. Full, this should reduce the cost of home and you may business finance and you can increase need for borrowing.

Eurozone financial lending so you’re able to houesholds and you will organizations

\r\n”>>” data-up-is=”rich-text” data-up-translation-read-more=”Find out more” data-up-translation-read-less=”Read Less” data-up-translation-aria-label-read-more=”Read more option, push enter to engage, or take up arrow key to learn more about this content” data-up-translation-aria-label-read-less=”Read quicker button, drive go into to interact, otherwise use up arrow key to find out about this content” data-up-analytics=”rich-text”>

Anticipating, Western european banks face a managing $800 loan today Jacksonville FL act in order to maintain sturdy harmony sheet sets, keep your charges down and continue support customers. The newest improvements companies make to help you digitalise even after a succession regarding monetary surprises and you can slow growth usually stay them during the an effective stead for longer-title victory, especially as we seek out stronger development of next year.

Financial credit increases so you’re able to sluggish so you can low peak within the a decade

Mortgages account for nearly 50 % of overall credit in eurozone, in addition to prediction slowdown for the mortgage development to one.5% from inside the 2023 and you will 2.4% during the 2024 is short for this new weakest year for the season raise more a good two-12 months months during the ten years, and you will a sharp . Discreet housing industry belief (rather for the Germany), highest credit can cost you and continued tightening out of financing standards is actually acting to minimize one another demand and you may mortgage accessibility.

Leave A Comment