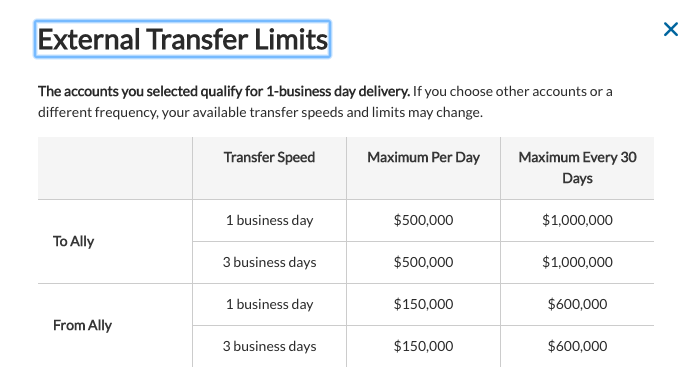

This option has been a well-known alternatives within the last pair years. NAB written a different sort of margin mortgage entitled NAB Equity Creator, and therefore performs similar to a home loan, but also for shares.

Your use some cash, lead some of their, and you may agree to build dominating & attract repayments each month such as home financing. Because of the investing in such costs, NAB say there will be no margin calls.

Fund begin at $10,000 and you just you desire a finances put to begin with otherwise a percentage profile to help you borrow secured on.

The speed often is lower than other margin options, however, generally nonetheless notably less attractive because the financial prices.

As much as i understand, NAB are definitely the only 1 providing a loan construction like this. This means he’s got a reasonable little bit of capacity to alter the rules, jack pricing up, and so on, once you understand you can not get the ditto somewhere else. Which can appear pretty unlikely, but it company website is nonetheless something you should envision.

If you cannot access any practical costs solutions, after that simply ensure that it stays simple and run getting many boosting your savings rate.

Committing to Tailored ETFs

Tailored ETFs can borrow money in the institutional’ costs, being cheaper than the average person can access. They use it to improve profile dimensions, into idea being to incorporate higher returns.

I authored from the leveraged ETFs right here towards Pearler site. For the reason that post, I talk about the latest performance over time, and just how brand new geared ETF fell 67% within the covid freeze, as markets itself try off from the 36%.

Almost nobody has the tummy for this. And it remains to be viewed the money perform would into the an even worse freeze of say fifty%. My personal guess was a geared ETF create fall in well worth by the to 80% or maybe more.

I encourage you to go take a look at the article, due to the fact I-go to the a lot of outline the issues one to geared ETFs face.

Interest rate considerations

Interest rates will not be it low forever. When the rates rise step one%, 2% or higher, how does one replace your means?

In the place of financial obligation, you’ll be able to hardly blink. Because of the using having borrowed money, you will be extremely alert and you may effect quicker confident with for each price increase.

You can quickly resent needing to generate mortgage repayments if you aren’t while making growth, otherwise bad, resting thanks to nasty losses. Power can very quickly turn an easy funding package towards an unhappy experience.

In case your investments belong worthy of, the debt continues to be the exact same. Which means your collateral is diminishing ahead of the sight. We have sufficient trouble coping with sector downturns because is. Including debt causes it to be actually more complicated.

Having fun with influence so you’re able to liquid your own production looks fantastic towards good spreadsheet. However in actuality where some thing dont rise during the a straight-line, it isn’t very easy.

Higher yield otherwise low-yield?

When taking to the even more debt to pay, you ought to meet with the money. Thus, many people go for offers where in fact the earnings they discover usually getting greater than the loan attract.

This is smoother psychologically, and you can virtually, once the you’re not having to dip into the own money to shelter the fresh shortfall, and you are clearly even getting some self-confident cashflow.

In addition, down yield high increases investment be much more tax effective since you can potentially claim the fresh new earnings-losses due to the fact a tax deduction. And additionally down produce choice (including global offers such as for example) will give you higher diversification.

You can find advantages and disadvantages to one another possibilities. You can always favor a pleasant middle crushed, for which you are not warping disregard the plan to possibly pursue higher efficiency or optimise getting taxation.

Leave A Comment