Over fifty percent of all the youngsters have taken into the particular version of loans in order to buy the degree primarily courtesy figuratively speaking. An average a fantastic balance due? Ranging from $20,000 and you may $24,999. When you’re one of those with education loan debt, preciselywhat are the choices to get a mortgage?

Just how can Loan providers Glance at Debt?When giving borrowing, lenders biggest issue is if a debtor can pay the mortgage straight back. They use enough calculations to figure it out. One of the main of them is always to divide the fresh new borrowers’ month-to-month costs by the monthly gross income. This might can i get payday loan if ive been on vacation be entitled a beneficial borrower’s obligations-to-money proportion.

Remember that lenders can look during the what you pay monthly, maybe not the total amount you borrowed from. If you have $20,000 inside education loan personal debt and make $200 monthly premiums, their financial uses new $2 hundred monthly installments on formula. Today, separate the total amount you pay every month by your terrible monthly income (just before taxes or any other write-offs). It’s your obligations-to-money proportion.

To acquire a concept of the debt-to-earnings proportion, check out the count you have to pay per month for your minimum borrowing card payments, auto loan, book, financial, education loan, or other monthly installments

Should you decide Lower Your College loans Prior to getting a property?Contemplating would love to pick property until their education loan bills is paid off can seem to be including getting your life with the keep. If or not you need to pay off or off your own beginner obligations very depends on your specific financial situation. The expense of property control far exceeds only the monthly mortgage costs. There’s insurance, property fees, utilities, repair, and lots of short expenses. On the bright side, making a wise financing in the property you certainly will give you economic balance on the right market.

Talk publicly together with your mortgage administrator to decide whether or not today ‘s the correct time on exactly how to put money into a property. They will be capable of giving your qualified advice regarding the actual house field, rates of interest, and you will monetary standards getting loans you are able to be eligible for.

Of a lot financing options are offered to people long lasting form of from debt they have. Certain favorites among young borrowers having student education loans try traditional, USDA, Virtual assistant, and FHA money.

Conventional loansIf you may have very good borrowing and will build a lower fee of at least step 3.5%, a traditional financing will provide many wonderful features along with PMI fees one to end when you started to twenty-two% guarantee of your house.

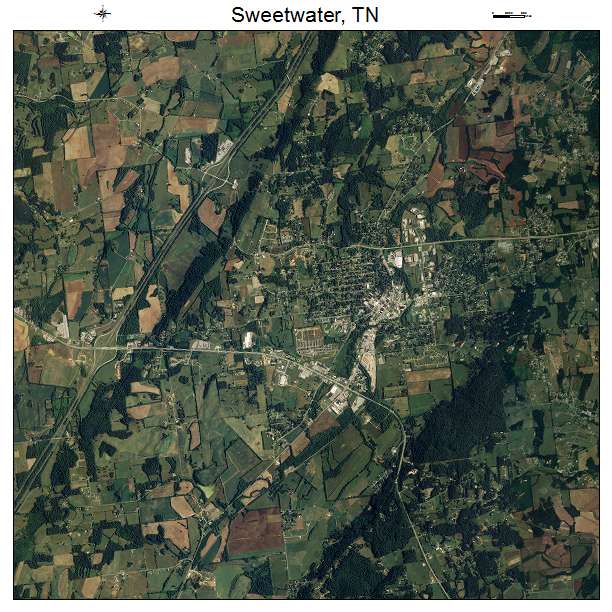

USDA loansIf you are searching to purchase a first household inside the an enthusiastic town defined as rural by the USDA, a good USDA loan is a great choices. Captain one of several advantages for those with student loan loans was a beneficial 0% lowest advance payment with no personal mortgage insurance premiums.

Va loansAnother higher 0% down-payment option for folks who are previous or latest participants of one’s U.S. army. Va financing are around for funds the acquisition regarding number one houses just.

They are offered to borrowers that have FICO fico scores as little as five-hundred

FHA loansIf your own borrowing from the bank has been decreased by the student loan payments, envision a keen FHA financing. You are going to need to create a downpayment from 3.5 to help you ten% according to your credit rating, nonetheless it could be a good idea to begin with strengthening financial balance having a property.

Should you decide Get A home Today?According to debt specifications, taking advantage of the low interest rates could be an effective choices. Contact your regional loan officer so you’re able to decide about whether you are able getting owning a home or if it can be much more great for wait.

Leave A Comment